![ISSUES IN PORTFOLIO SELECTION - The Theory and Practice of Investment Management: Asset Allocation, Valuation, Portfolio Construction, and Strategies, Second Edition [Book] ISSUES IN PORTFOLIO SELECTION - The Theory and Practice of Investment Management: Asset Allocation, Valuation, Portfolio Construction, and Strategies, Second Edition [Book]](https://www.oreilly.com/api/v2/epubs/9781118067567/files/fabo_9781118067567_oeb_045_r1.gif)

ISSUES IN PORTFOLIO SELECTION - The Theory and Practice of Investment Management: Asset Allocation, Valuation, Portfolio Construction, and Strategies, Second Edition [Book]

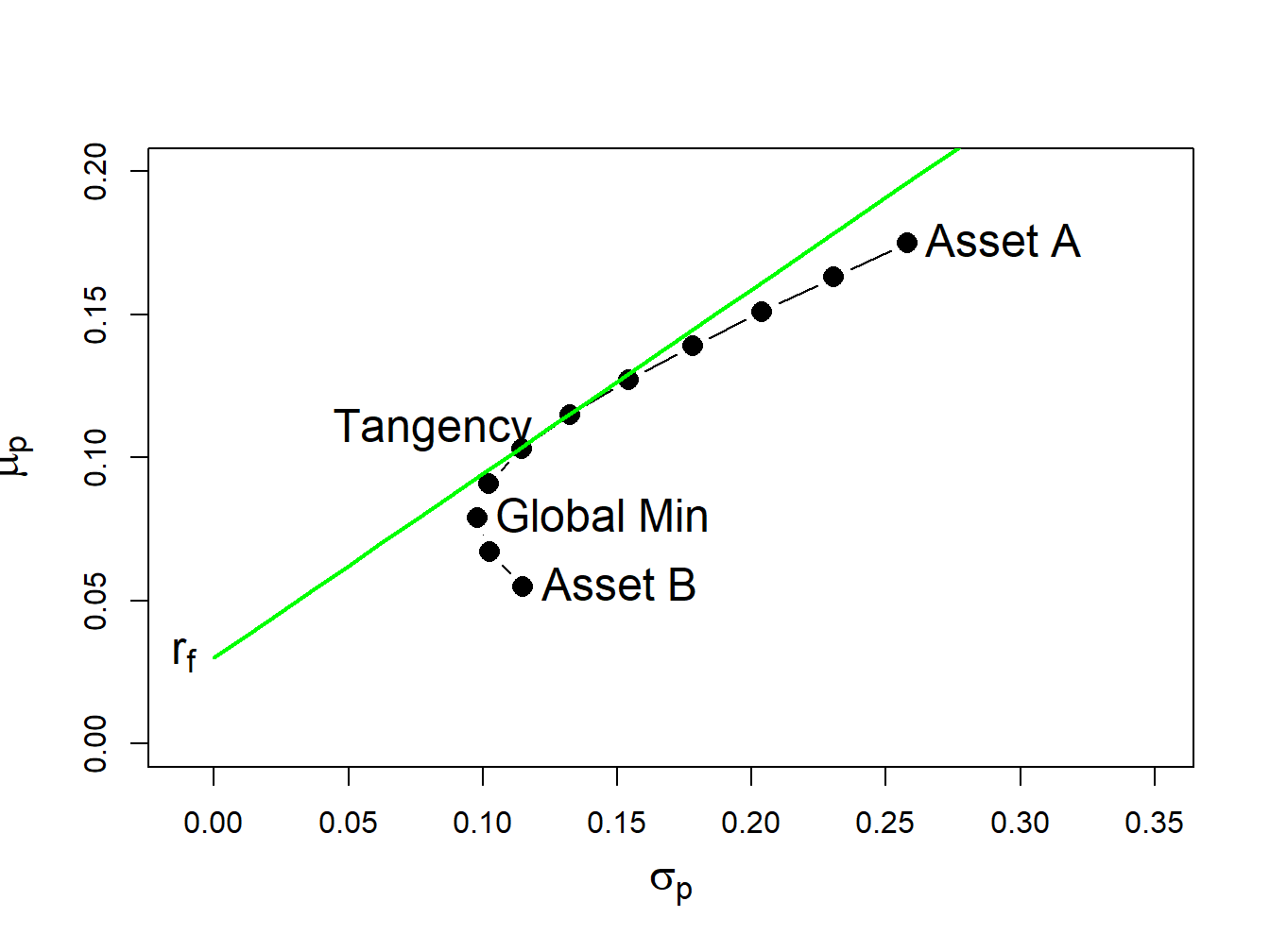

13.2 Portfolio Theory with Short Sales Constraints in a Simplified Setting | Introduction to Computational Finance and Financial Econometrics with R

Chapter 8 Risk-Aversion, Capital Asset Allocation, and Markowitz Portfolio- Selection Model 1 By Cheng Few Lee Joseph Finnerty John Lee Alice C Lee Donald. - ppt download

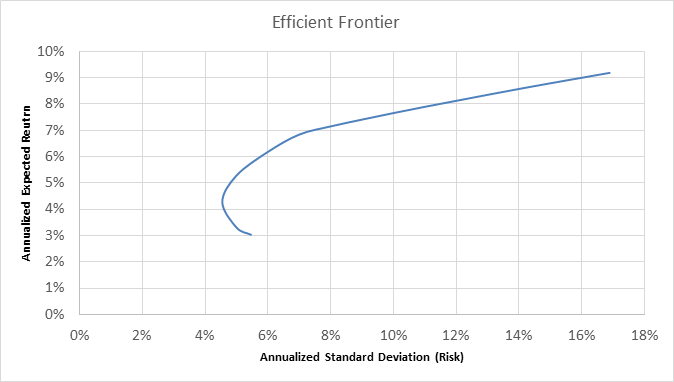

Efficient Frontier - Portfolio optimisation (optimization) with and without short-selling - File Exchange - MATLAB Central

The efficient frontier for the ten assets with and without short sales... | Download Scientific Diagram

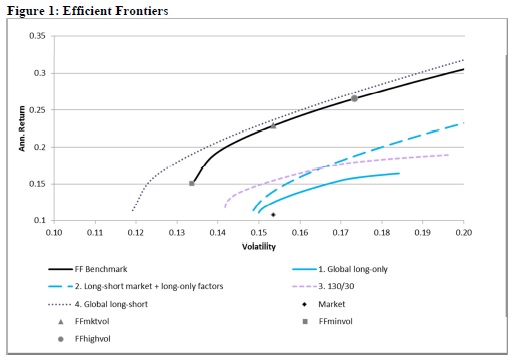

Wright meets Markowitz: How standard portfolio theory changes when assets are technologies following experience curves - ScienceDirect

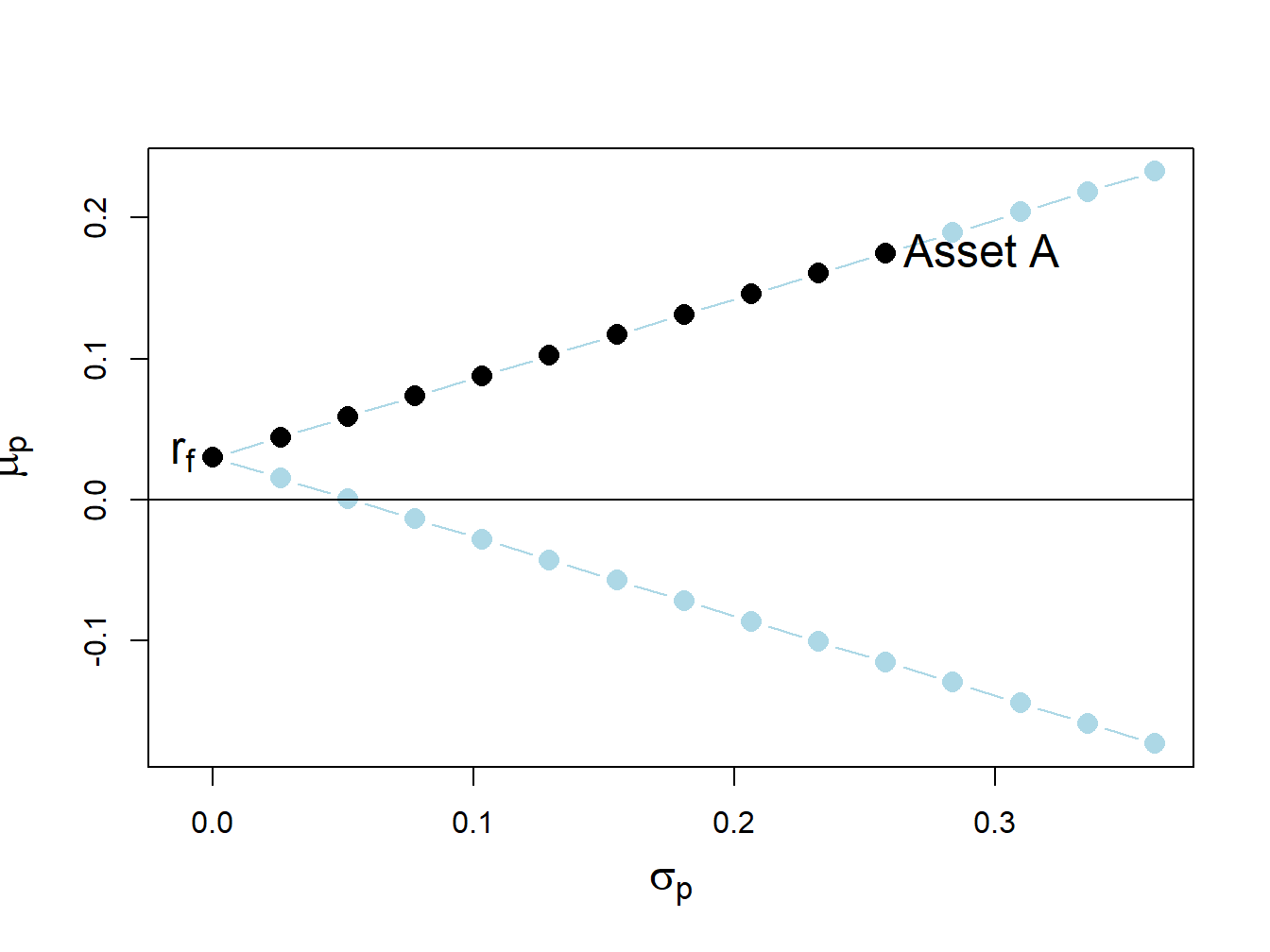

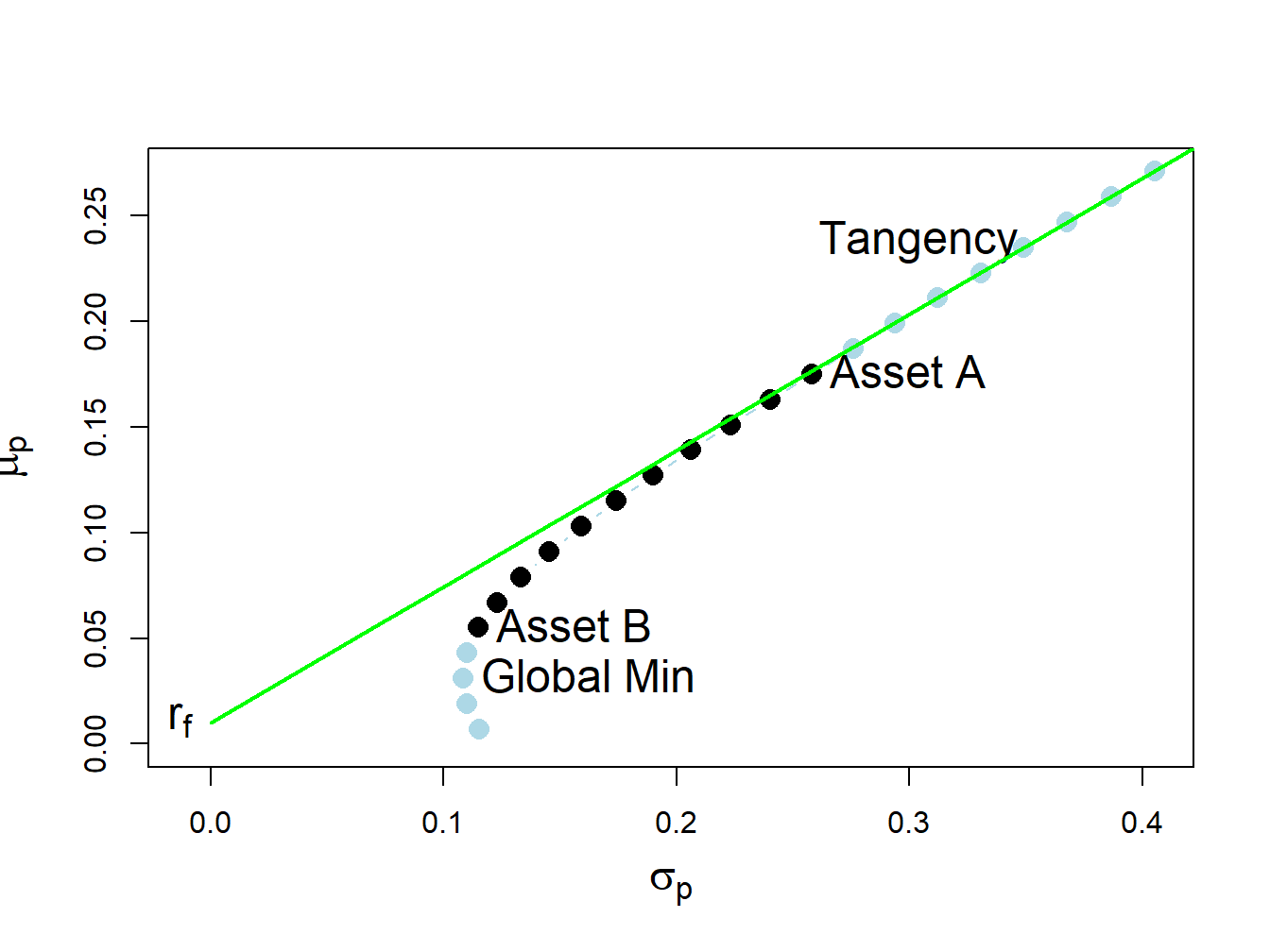

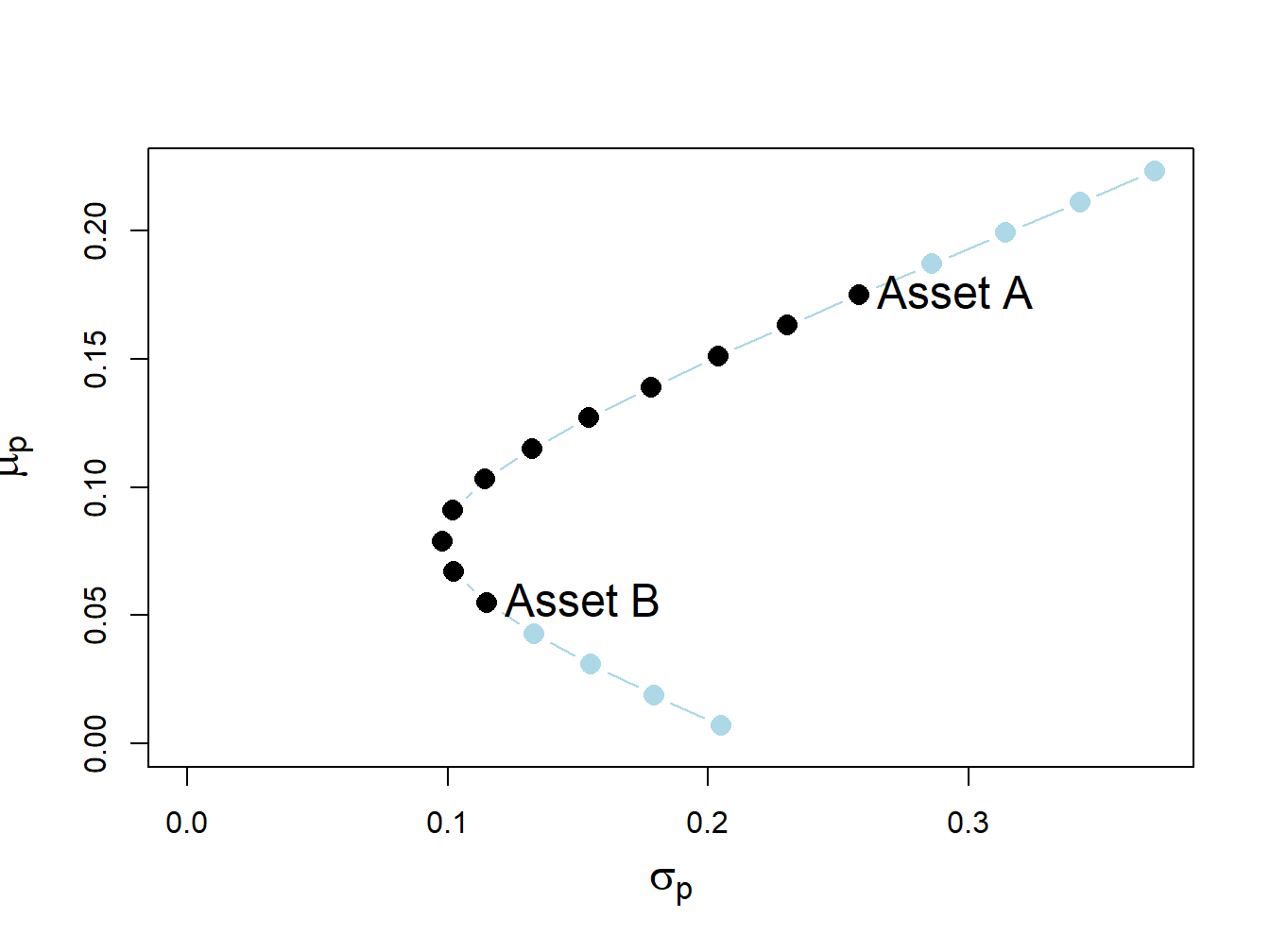

13.2 Portfolio Theory with Short Sales Constraints in a Simplified Setting | Introduction to Computational Finance and Financial Econometrics with R

13.2 Portfolio Theory with Short Sales Constraints in a Simplified Setting | Introduction to Computational Finance and Financial Econometrics with R