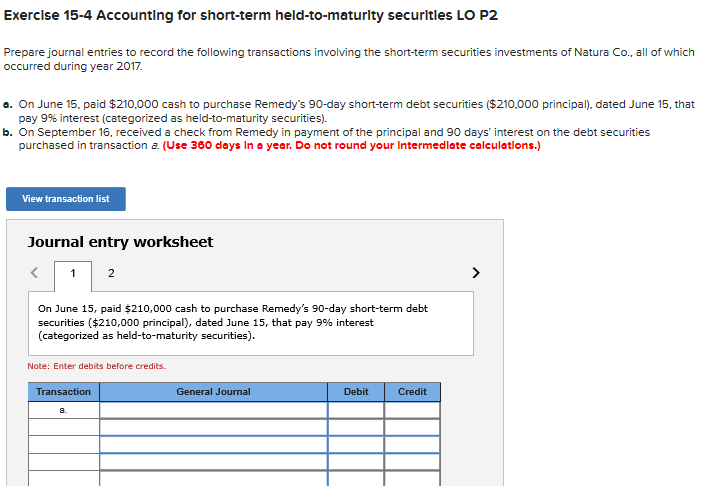

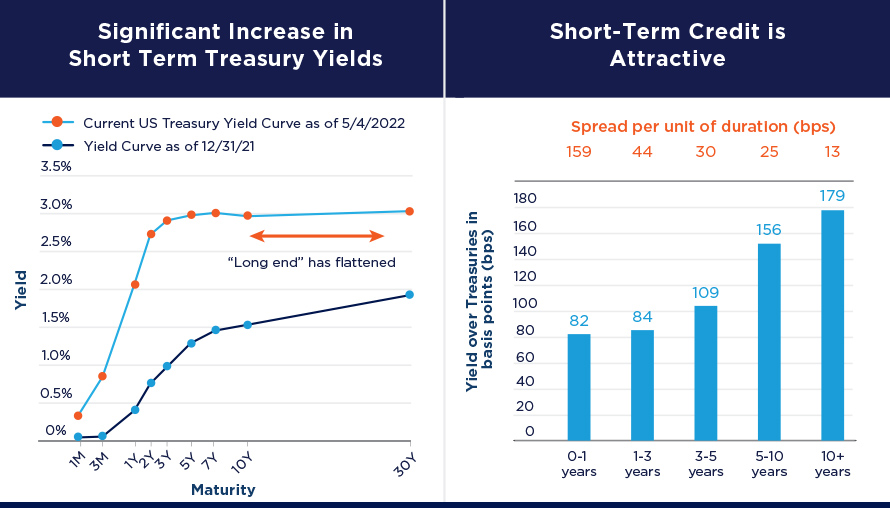

Schwab Short-Term U.S. Treasury ETF: A Stable Fund With Low Volatility (NYSEARCA:SCHO) | Seeking Alpha

Russia External Debt: Short Term: Within 1 Year: Residual Maturity (RM) | Economic Indicators | CEIC

Amazon.com: Debt Maturity and the Use of Short-Term Debt eBook : Chen, Sophia, Ganum, Paola, Liu, Lucy Qian, Martinez, Leonardo, Martinez Peria, Maria Soledad: Books

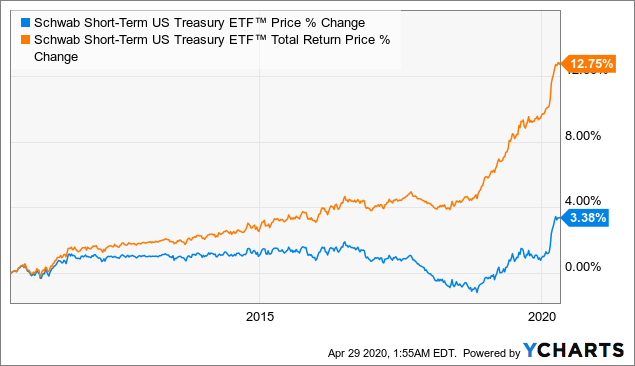

Amount Outstanding of Domestic Money Market instruments in General Government Sector, Short-Term at Original Maturity, Residence of Issuer in Canada (DMMISTRIAOGGCA) | FRED | St. Louis Fed

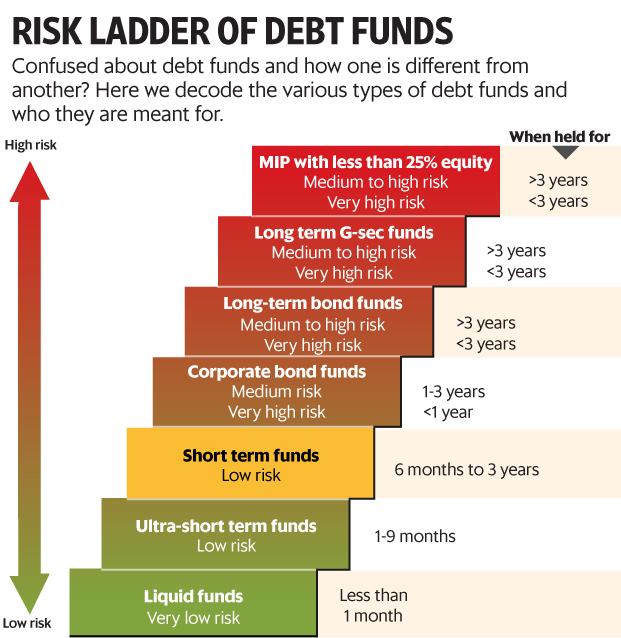

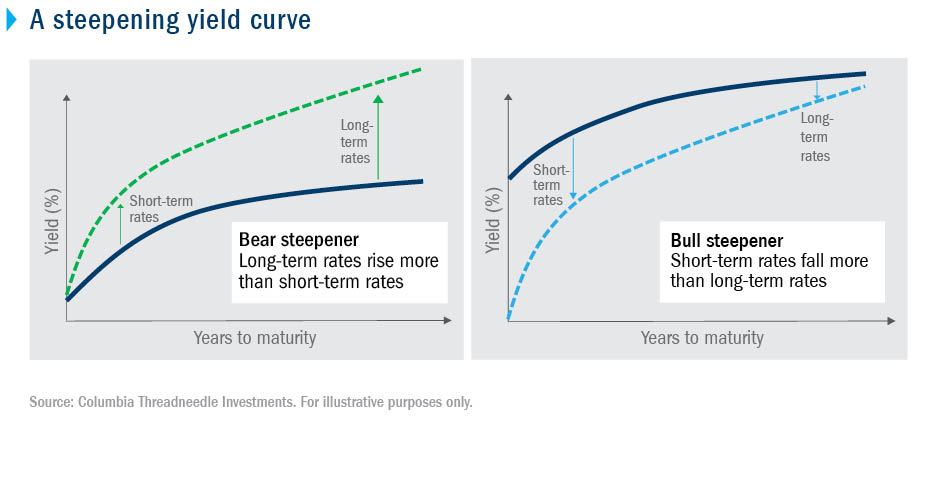

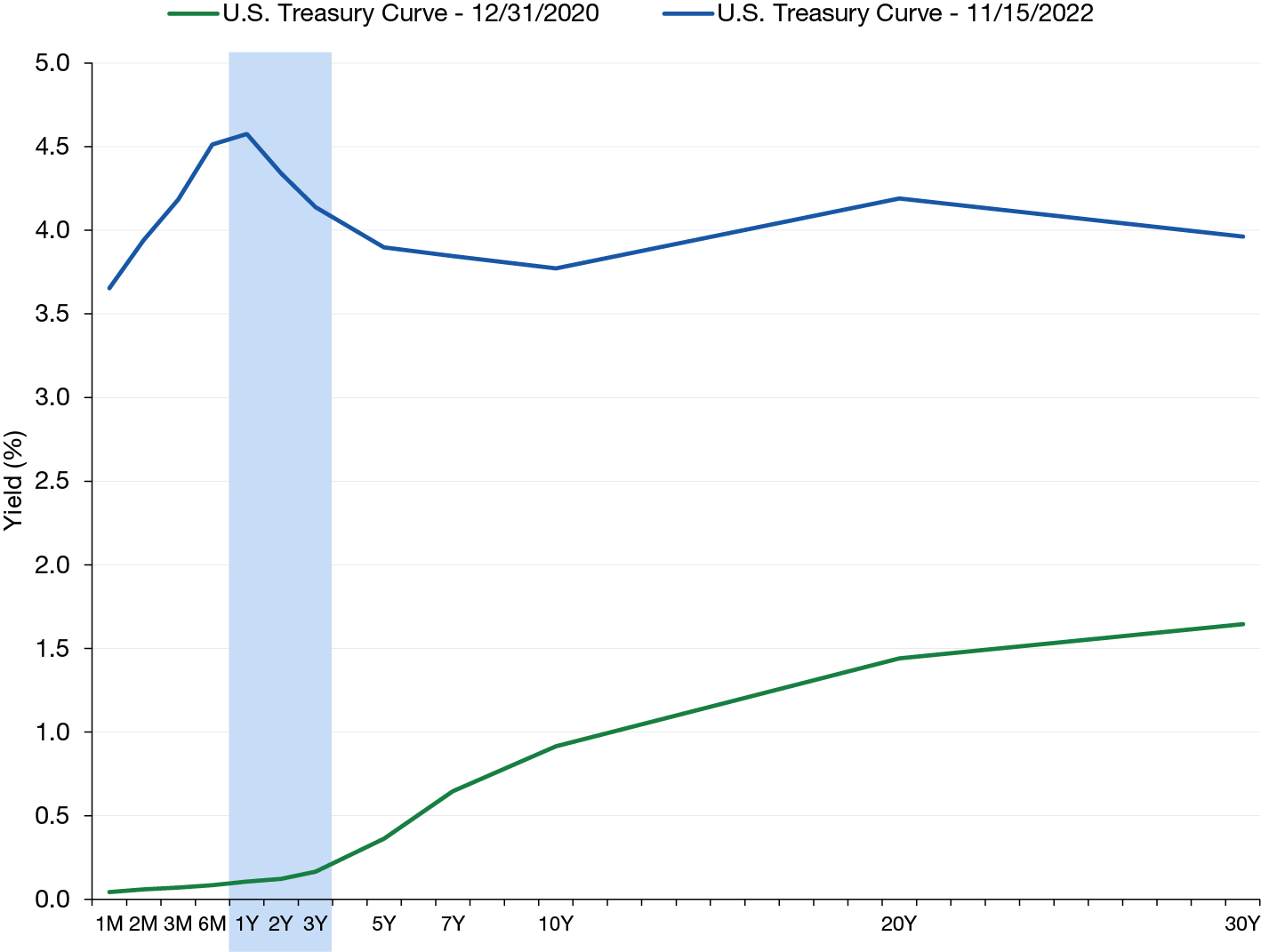

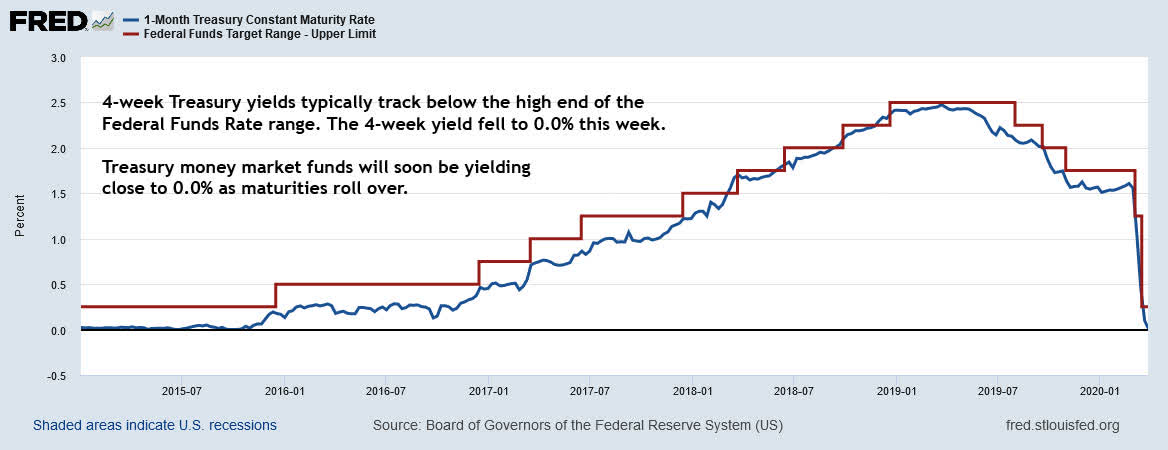

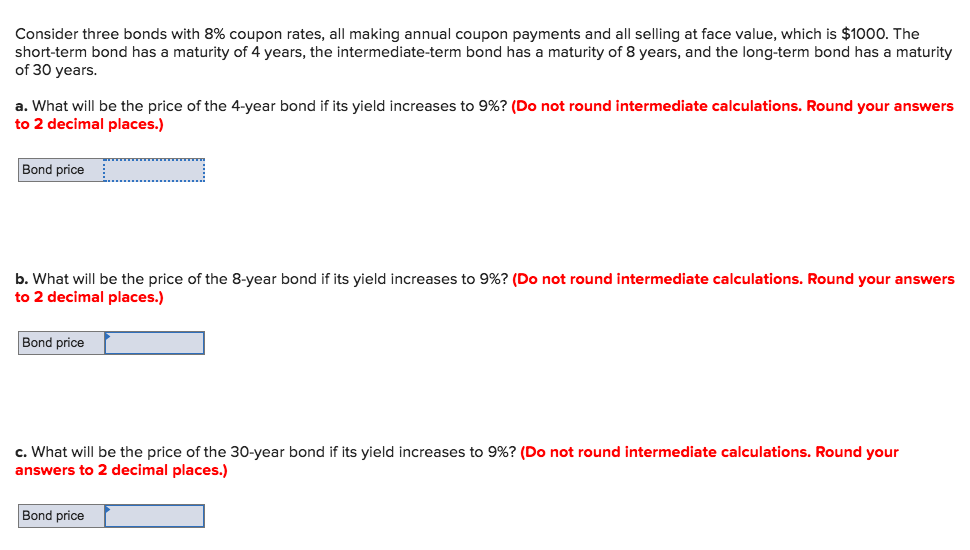

If short term interest rates are lowered to approximately zero percent, how does this impact the Bond Yield Curve (is it normal or inverted)? Draw the curve, with the axes labeled properly.

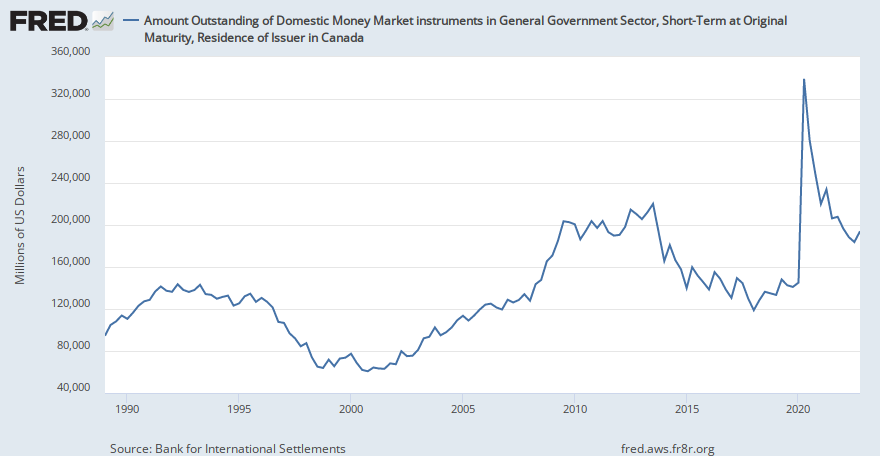

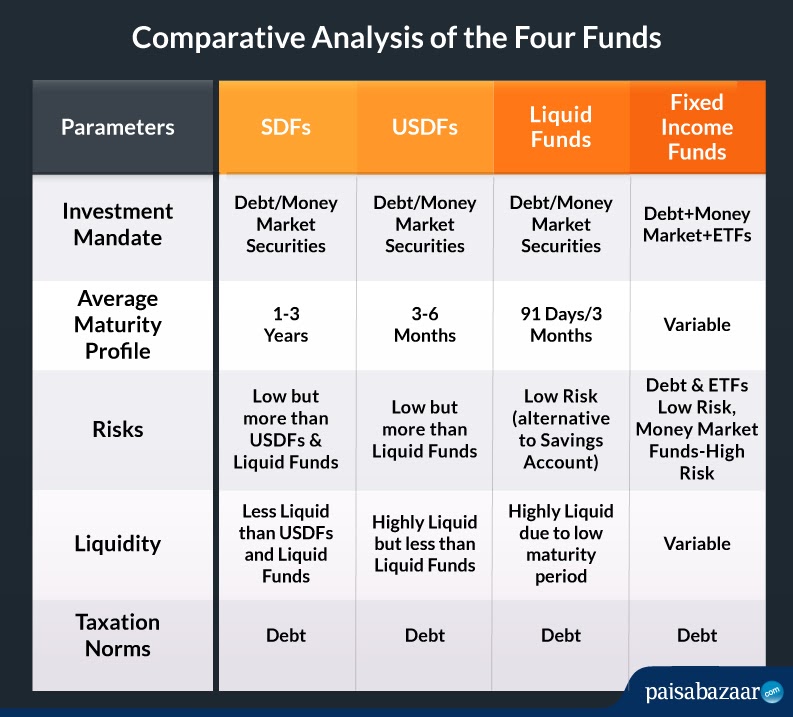

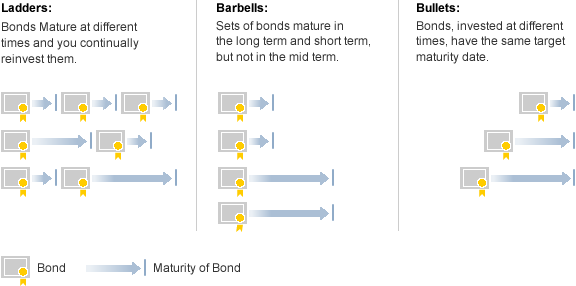

Mutual Funds – Short-Term Bond Funds Can Help Maintain Your Asset Allocation – kesari financial services

:max_bytes(150000):strip_icc()/YieldCurve2-362f5c4053d34d7397fa925c602f1d15.png)

:max_bytes(150000):strip_icc()/invertedyieldcurve_final-25d38e62233047bd9507553337f4413d.png)