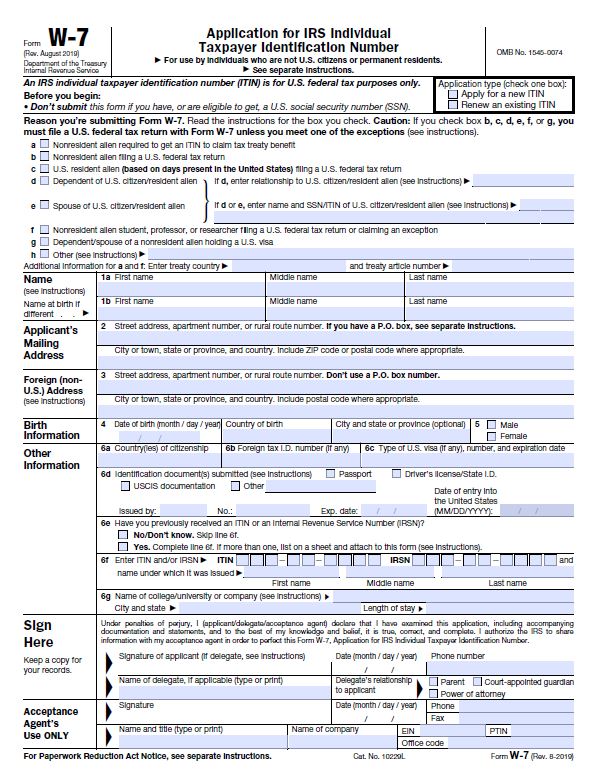

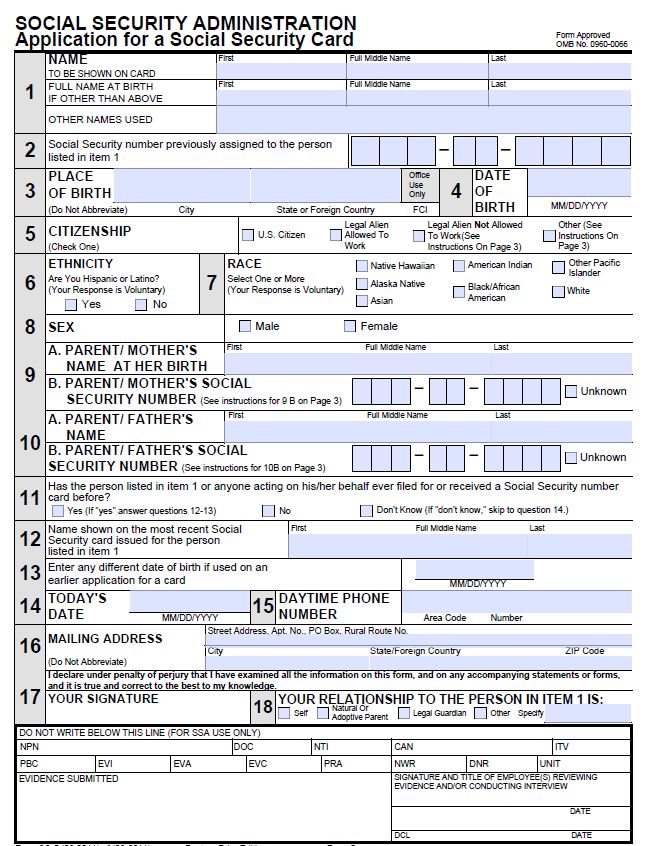

U.S. INCOME TAX FREQUENTLY ASKED QUESTIONS PLEASE NOTE: F-1 and J-1 students should consult with the International Office at the

Residency status for F1 visa international students on OPT/CPT using Substantial Presence Test – 1040NRA.com

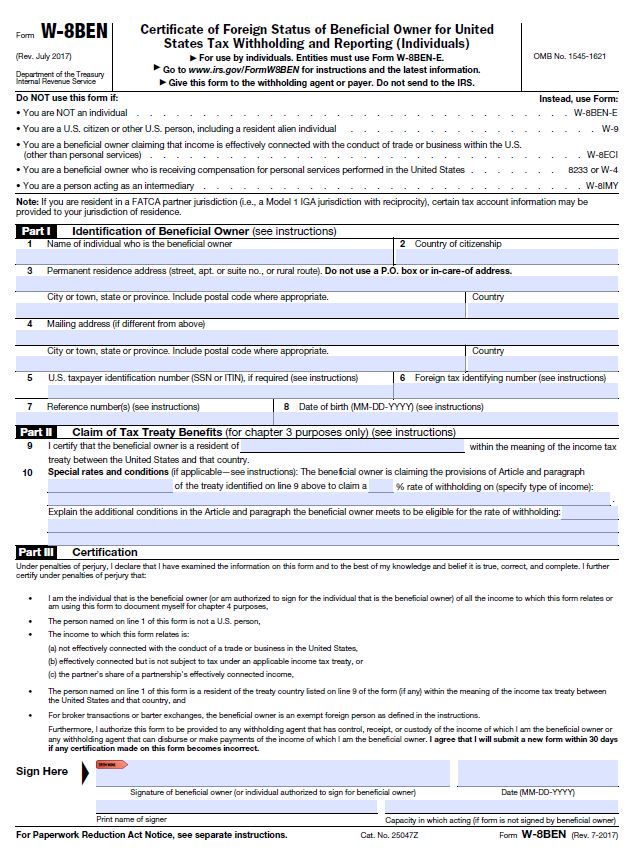

Internal Revenue Code requires that 14% tax be withheld on nonqualified scholarships received by a nonresident alien individual

Suite 301, 4200 W Jemez Rd, Los Alamos, NM 87544 505-412-4200, fax 505-212-0049, info@newmexicoconsortium.org Substantial Presen

![US Tax Return & Filing Guide for International F1 Students [2021] US Tax Return & Filing Guide for International F1 Students [2021]](https://tfxstorageimg.s3.amazonaws.com/wb8qospb36c1ssjs2zcfsg5b9373)