Nick Carr on Twitter: "Important for eTrade data export - make sure you delete the "Summary" row in the CSV. If you're seeing a value of "MULTIPLE" in your #PivotTable (picture 1),

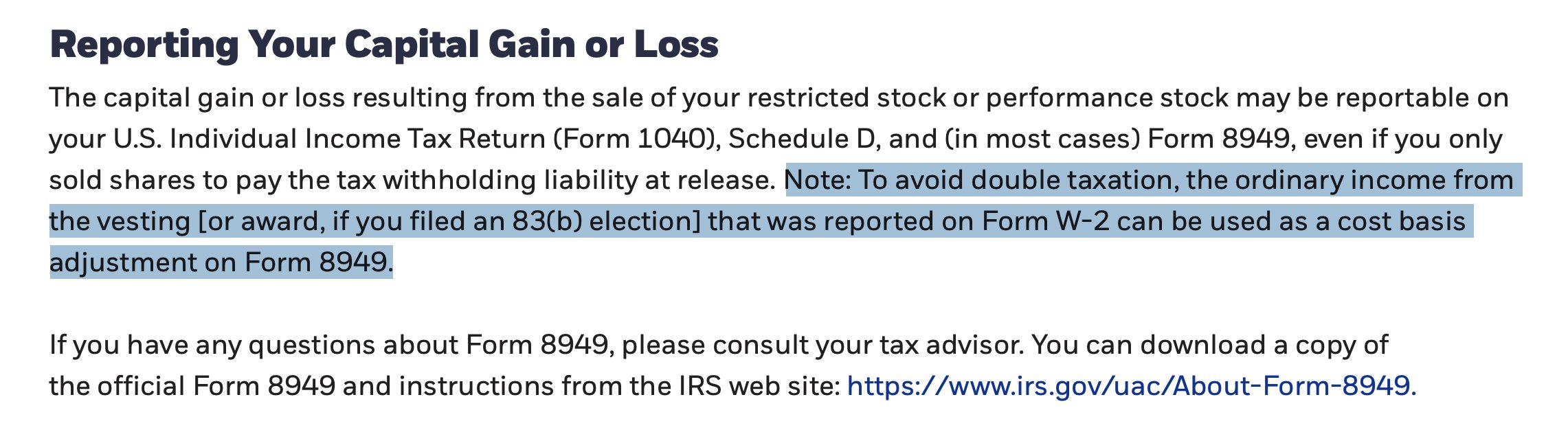

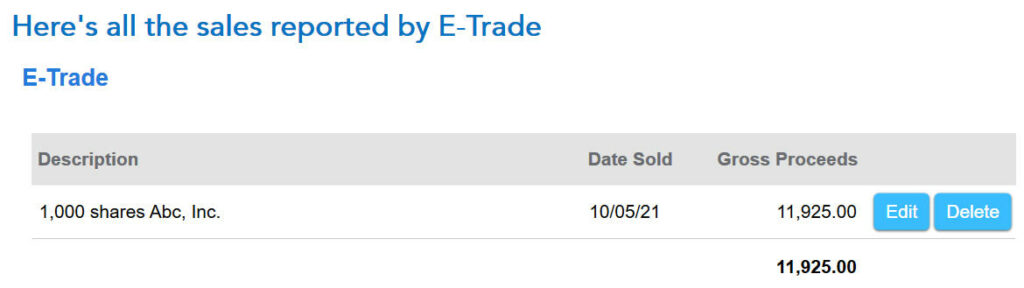

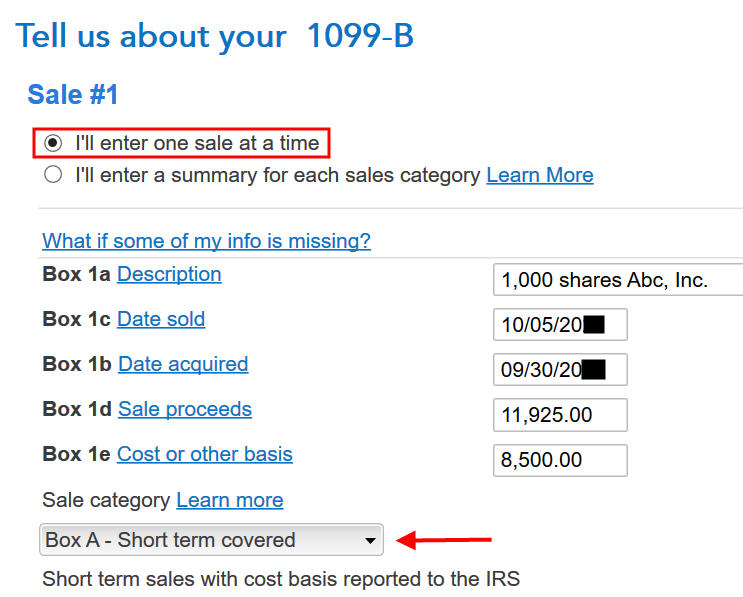

united states - What is the cost basis for my RSU? My 1099-B says $0 - Personal Finance & Money Stack Exchange

Nick Carr on Twitter: "Important for eTrade data export - make sure you delete the "Summary" row in the CSV. If you're seeing a value of "MULTIPLE" in your #PivotTable (picture 1),

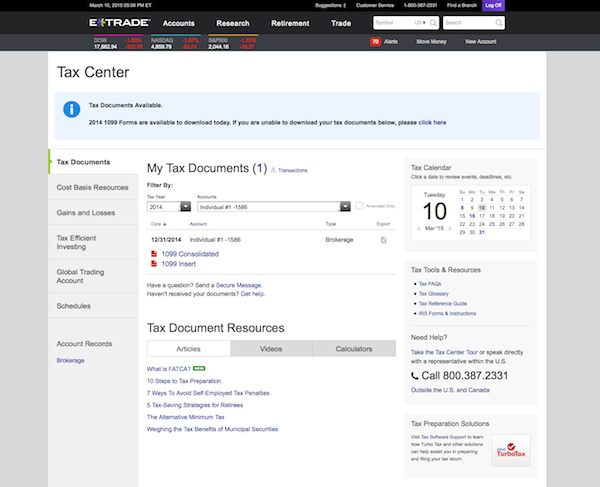

Uživatel Nick Carr na Twitteru: „Time to file an 8949 correctly reporting RSU cost basis! Remember, if you haven't downloaded your full eTrade Gains & Losses, you probably haven't done this correctly

:max_bytes(150000):strip_icc()/wealthfront-vs-etrade-core-portfolios-3cf44d7f34e846d6993d425e0d9f3888.jpg)